Gateway Chosen

Selected Gateway

NMI

Selection Settings

Evenly distribute across the gateway list formed from gateway group(s):

- Acme Inc. Gateways

AND

Prefer gateway if any of the following:

- Previously Approved For Customer

AND

Do not choose gateway if any of the following:

- Previously Declined For Customer

AND

Do not choose gateway if in any of the following gateway group(s):

- Closed MIDs

AND

As a failsafe, if no gateways end up being chosen, randomly choose from the following gateway(s):

- Backup Gateway

Payment Success

Amount

$125.08

- ID: aW5NrjYPLLA9v

- Gateway: NMI

- Gateway Trans. ID: 4691520268

- Gateway Response: Approved

- Gateway Auth Code: 531921

Payment

Gateways

Add your merchant account gateways to RevCent in no time. RevCent currently supports several gateways and are constantly adding new ones.

1 Pick Your Gateway

Choose the payment gateway you are using from the list of gateways available in RevCent.

2 Enter Credentials

Enter the credentials provided by the gateway. Include the discount rate and fees for profit reporting.

3 Process Payments

Once a gateway is added, you are immediately able to process credit card transactions using RevCent.

Payment

Routing

Payment profiles allow you to route payments to the gateway you want, with simple or advanced processing and routing logic.

Next-Gen or Basic

RevCent offers two types of payment profiles, the Next-Gen Profile and the Basic Profile.

Dynamic Routing

Payment profiles allow you to route payments to the optimal gateway at time of payment.

Increase Approvals

Utilizing payment profiles in conjunction with rules, filters and groups, will increase approvals.

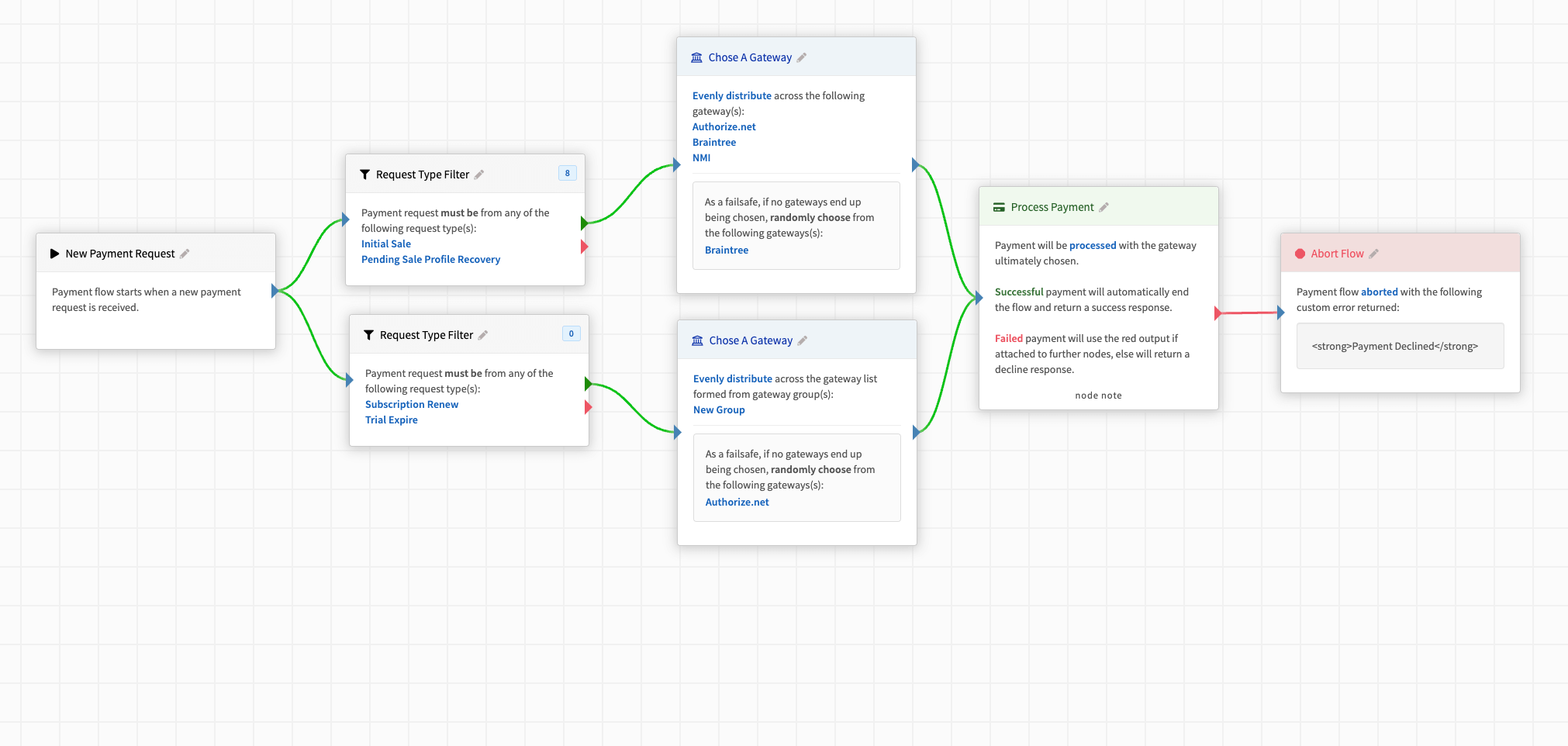

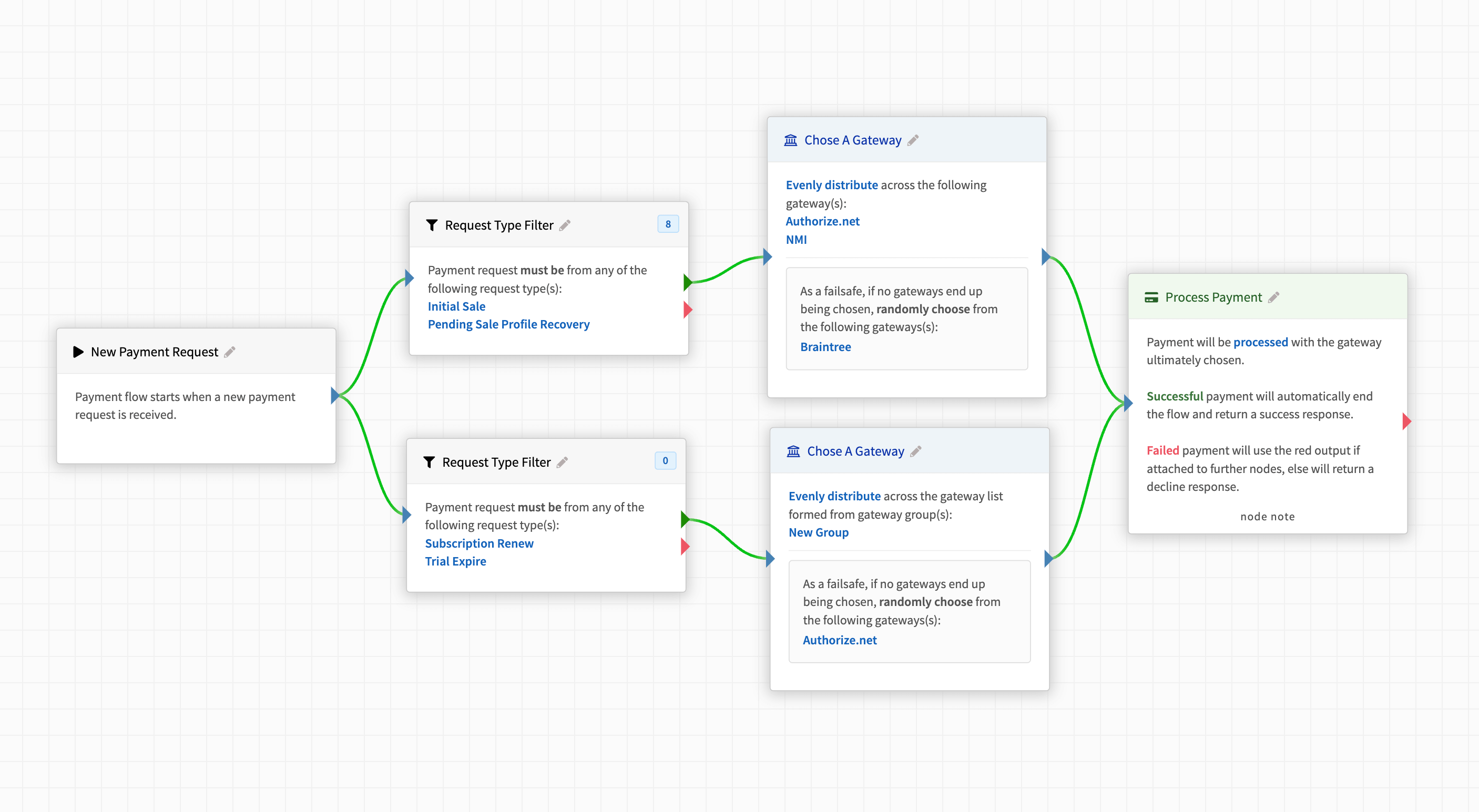

Next-Gen Profile New

The Next-Gen profile is a payment router which you design using the visual payment flow builder.

- Great for businesses with advanced payment needs.

- Payment flow is created using the visual builder.

- Filters, branching and pre/post payment actions.

- Gateway choice settings offer unlimited potential.

Multiple Stores

You have more than one store, each with its own corporation. You want to prevent unintended gateway exposure while keeping approvals high.

Advanced Routing

You require advanced payment routing logic, including initial sales versus upsells, customer retries and scenarios which require specificity.

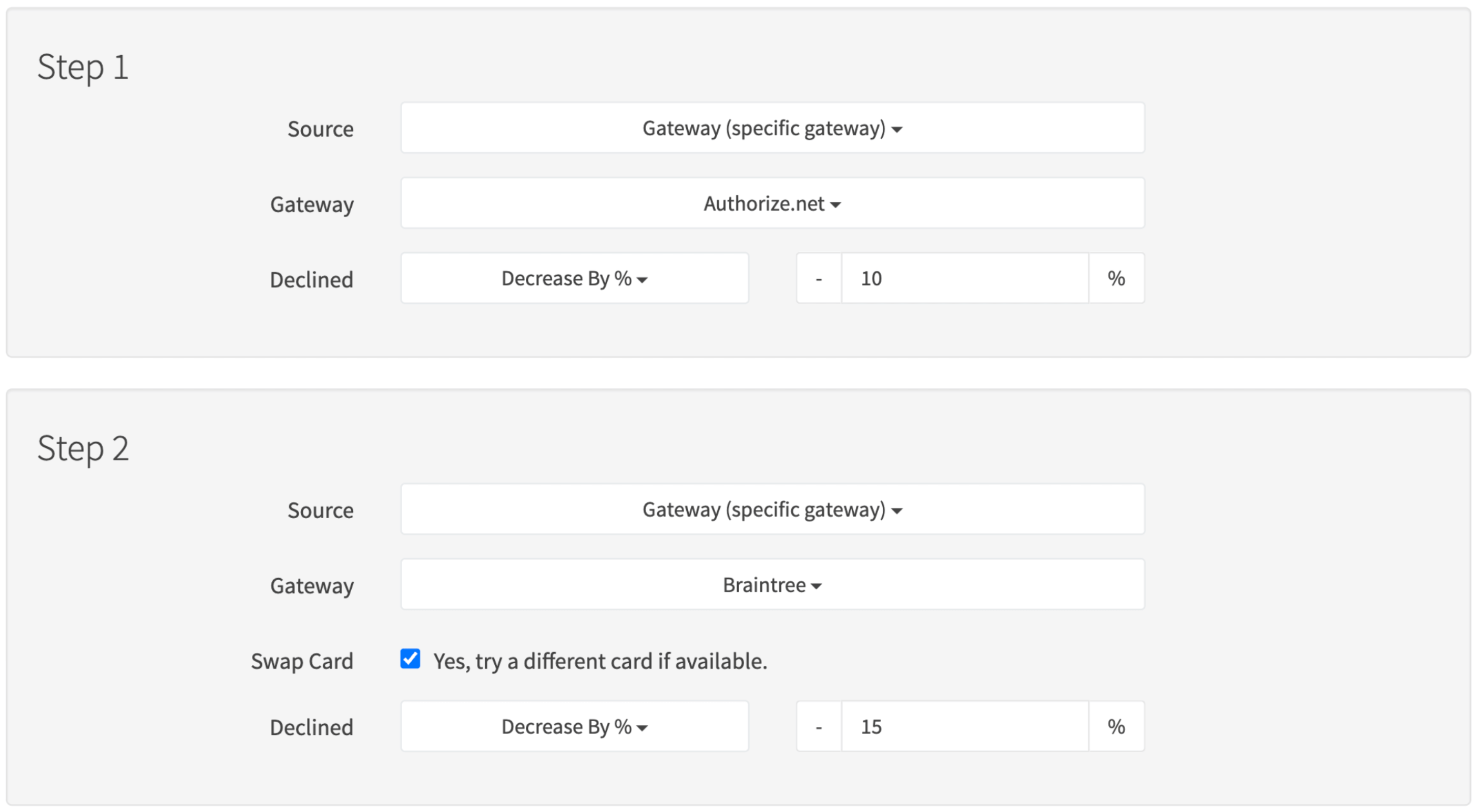

Basic Profile Simple

The Basic profile is a step based payment router, with up to three steps, allowing simplified routing.

- Useful for basic payment processing.

- Payment flow is a fixed, max 3 step design.

- Each step can be a static or dynamic gateway.

- Gateway choice settings are limited in capability.

Single Store

Your business consists of a single store and corporation, with consistently high approval rates and minimal to no chargebacks.

Simple Routing

You only require basic payment routing, without the need for custom filtering, distribution or gateway choice logic.

SmartBin

SmartBin gives you the ability to process payments using the gateway that has the highest statistical likelihood of success.

Intelligent Scoring

Each time a payment request is received, SmartBin scoring takes place and the best gateway is chosen.

Statistical Analysis

Your transaction history is analyzed, with time frames, anomalies and gateway volume considered.

Increased Approvals

Greatly increase your approvals by using the best gateway specific to the customer card being used.

How It Works

SmartBin is a complex mix of statistical analysis, time comparisons, anomaly avoidance and more, while at the same time not overloading gateways.

1 Payment Requested

A credit card payment request is received by RevCent via API, web app or online store.

2 Card Analyzed

The customer credit card being used is analyzed, including issuer details.

3 Gateways Scored

All available gateways are scored in under a second using the SmartBin algorithm.

4 Payment Processed

Payment is processed using the most favorable gateway based on the scoring results.

Use It Now

Increase approvals immeditately by enabling SmartBin in your payment profile.

Every Payment

Each payment request that is received is analyzed to find and use the most favorable gateway.

Sub-Second Scoring

Scoring is unique to each request and conducted in under a second, avoiding overall payment latency.

Revenue

Recovery

Recover lost revenue, including abandoned carts and failed renewals, using RevCent's automated revenue recovery tools.

30%

Soft Decline

recovery rateA soft decline occurs when a customer either submitted incorrect info, asked to contact their bank, etc. Soft declines have the highest recovery rate.

- Utilize a Next-Gen payment profile to parse a gateway response.

- Provide specific terms which must match within the response.

- If a match occurs, create a custom error message to display.

- Display the error message to the customer during checkout.

15%

Abandoned Cart

recovery rateAn abandoned cart occurs when a customer tried to pay for an initial sale, but all attempts were unsuccessful. At RevCent we call this a pending sale.

- Utilize AI Assistants to retry failed initial sales.

- Simply prompt the AI to review the sale and attempt payment.

- System tools are available for the AI to conduct actions.

- AI can process the re-attempts automatically.

13%

Hard Decline

recovery rateEncompasses all other declined payment attempts that were either fully rejected, or were partially successful via transaction amount reduction.

- Utilize a salvage transaction profile to recover lost revenue.

- Can apply to failed renewals, failed trial expirations and sales.

- Set specific rules and filters, including max number of attempts.

- Process the recovery attempts automatically or manually.

Chargeback

Management

RevCent's easy to implement API and document feature allow third party chargeback management companies to integrate, fight and update chargeback representment data.

API

Utilize the RevCent API to create a chargeback, retrieve evidence and modify a chargebacks' details.

Implementation

Easily create a chargeback in RevCent specific to a transaction. You can provide the gateway transaction ID or the RevCent transaction ID.

Well Documented

Check out our API docs for examples, schemas and more.

Evidence

Documents in RevCent are the important details regarding a specific item and can be accessed via web app or API. The document feature is especially useful for fighting chargebacks.

Doc JSON

The raw JSON will contain all info specific to the transaction which has a chargeback, including tracking visitor information, IP details and more.

Doc ZIP

The document ZIP file will contain the raw JSON data as well as a friendly formatted .docx file. You can download the ZIP file in the web app or using the zip_url property in the API call response.

Customer

Card Storage

RevCent is a certified PCI DSS Level 1 service provider and securely stores customer credit cards.

PCI Level 1

Our PCI DSS Level 1 certification allows us to store customer card data on behalf of our users.

Encryption

RevCent utilizes the latest encryption for all communication, access and payment data storage.

Monitoring

RevCent runs on AWS, which provides enhanced monitoring capabilities and threat detection.

How It Works

When RevCent encounters a non-existing card for a customer, it will validate, enrich with BIN data and securely store it.

1 New Card

A new card is either detected during an initial sale request, created using the API or added via web.

2 Card Validated

The new credit card is validated, enriched with BIN data and undergoes multiple fraud checks.

3 Card Stored

If the card is valid and does not already exist, it will be securely stored on behalf of the user.

4 Card Processed

Any initial sale requests or future payments for the customer are processed using the stored credit card.

How You Benefit

Saved customer payment data can be used for additional purchases, renewals and trial expirations.

Additional Purchases

Use the stored card for future purchases such as upsells, new orders and more.

Subscription Renewals

Subscriptions are renewed using the current default customer card within RevCent.

Trial Expirations

Trial expirations will use the customer card from the initial sale associated with it.

MID

Management

Stop losing merchant accounts, and increase approvals, by properly managing them using RevCent's suite of payment, anti-fraud and reporting tools.

Gateway Groups

Properly organize your merchant accounts and prevent unintended gateway exposure using gateway groups.

- Create a gateway group for each merchant account corporation you plan to add to RevCent. You will use the gateway group feature as a MID corp. organizer.

- When adding a merchant account, set the corresponding gateway group according to the corporation the MID is associated with.

- Utilize gateway group restrictions within payment profiles to prevent individual customers from unintended gateway exposure.

- When a customer transacts with a specific gateway group, they will only be allowed to transact with MID's in the same group.

Revenue Rules

Utilize revenue rules for individual MID's, including volume, chargebacks, declines and more.

- Prevent RevCent from using a MID if one or more revenue rules do not pass. Revenue rules can be based on volume, chargebacks, and time.

- Depending on your monthly cap for a MID, set a daily limit on the amount captured, preventing the MID from processing once the limit has been reached.

- You have the ability to prevent processing on a specific MID if the number, or volume, of decline transactions has reached a specific treshold you specify.

- If chargeback management is properly integrated, you can prevent processing on a MID that has surpassed a specific number of chargebacks.

Next-Gen Profiles

Use the Next-Gen Payment Profile to retry transactions on the same gateway if specific gateway error messages are returned.

- If a MID returns a CVV error response or code, a Next-Gen profile allows you to return a custom error message to the customer.

- If a MID returns a Contact Bank or Pick Up Card error, ask the customer to contact their bank, then retry on the same MID.

- If offering upsells, retry on the same MID that the customer was approved on for the initial sale, ensuring processing success.

- If a customers' payment is declined, prevent the same MID from processing the transaction on any additional payments for the customer.

Sentinel Anti-Fraud

RevCent offers Sentinel, an in-house multi layered anti-fraud system which protects your account from processing fraudulent charges.

- Utilize Sentinel, an anti-fraud tool built by RevCent, designed after years of experience with ecommerce payments.

- Sentinel prevents fraudulent payments from ever processing on a MID, and saves fraud data to prevent future attempts.

- Every payment attempt undergoes three separate anti-fraud mechanisms: Fraud Firewall, Visitor Validator and a third party check.

- You have the ability to customize the behavior and strictness of Sentinel, allowing certain payment attempts to be processed.

Reporting

Keep track of your MID's approval rates and overall performance using the reporting tools that RevCent offers.

- Check to see if MID's are underperforming, or have exceeded their cap, using the pre-built report pages or the custom dashboard.

- View individual MID chargeback rates, including by request type and method, to identify any problematic payments you may need to address.

- Decline rates and overall decline volume can be viewed on the Payments Report page, with the ability to group by metadata or other variables.

- Set up automatic notifications based on a specific metric related to one or more MID's using the Auto Query feature built into the custom dashboard.